Ape in (buy the latest token)#

This is an example automated trading strategy how to buy in to all tthe latest tokens.

This can act as a real strategy, but not recommended.

This strategy is based on QSTrader backtesting engine integration.

The trading universe is all DEX trading pairs. To speed up the simulation in this notebook, we limit the trading strategy to a tokens that meet the certain criteria. Note that you should not do this for the real backtesting, as this induces survivorship bias.

The trading strategy is a multi-asset strategy that rebalances the portfolio daily.

For each day, the strategy checks newly available tokens that have come to the markets.

When the tokens cross the liquidity threshold (have enough liquidity) the strategy buys those tokens, by selling the tokens from the previous day and equally balancing the generated cash in hand across all the tokens of the day.

The strategy sells the tokens on the following day - the sell signal is 1 day hold.

There is a high cash buffer, as the strategy is deemed to make a lot of unsuccessful picks.

This is a simplified example strategy that ignores loss of trade balance due to slippage, currency conversions, etc.

The backtest simulation takes some minutes to run. We display the progress using an interactive tqdm progress bar.

Creating a dataset client#

First let’s import libraries and initialise our dataset client.

[1]:

try:

import tradingstrategy

except ImportError:

%pip install trading-strategy

import site

site.main()

from tradingstrategy.client import Client

client = Client.create_jupyter_client()

Started Capitalgram in Jupyter notebook environment, configuration is stored in /Users/mikkoohtamaa/.capitalgram

Strategy and backtesting parameters#

Here we define all parameters that affect the backtest outcome.

[2]:

import pandas as pd

# The starting date of the backtest

# Note: At the moment, due to QsTrader internal limitation,

# we define this as NYSE UTC trading hours

start = pd.Timestamp('2020-10-01 14:30:00')

# The ending date of the backtest

end = pd.Timestamp('2021-01-08 23:59:00')

# Start backtesting with $10k in hand

initial_cash = 10_000

# Prefiltering to limit the pair set to speed up computations

# How many USD all time buy volume the pair must have had

# to be included in the backtesting

prefilter_min_buy_volume = 5_000_000

# When this USD threshold of bonding curve liquidity provided is reached,

# we ape in to the token on a daily close.

min_liquidity = 250_000

# How many tokens we can hold in our portfolio

# If there are more new tokens coming to market per day,

# we just ignore those with less liquidity

max_assets_per_portfolio = 5

# How many % of all value we hold in cash all the time,

# so that we can sustain hits

cash_buffer = 0.33

Setting up logging#

QStrader and Capitalgram use Python logging facilitiese with different logging levels to allow you diagnose any issues with the strategy. We set up logging here so that all INFO level messages are outputted.

Here is a tutorial how to use Python logging framework with Jupyter Notebook.

[3]:

import sys

import logging

# Create a Python logger

logger = logging.getLogger("Notebook")

logging.basicConfig(stream=sys.stdout, level=logging.INFO)

logging.info("Logging has been set up")

INFO:root:Logging has been set up

Creating the trading universe#

We take all trading pairs registered on Capitalgram (as the writing of this all Uniswap v2 compatible exchanges). As the number of trading pairs is very high (50k+). Most of these trading pairs are random noise and crap. We reduce the number of trading pairs to speed up the backtest simulation, but this also introduce some survivorship bias.

[4]:

from tradingstrategy.frameworks.qstrader import prepare_candles_for_qstrader

from tradingstrategy.liquidity import GroupedLiquidityUniverse

from tradingstrategy.pair import PandasPairUniverse

from tradingstrategy.timebucket import TimeBucket

from tradingstrategy.candle import GroupedCandleUniverse

from tradingstrategy.exchange import ExchangeUniverse

def prefilter_pairs(all_pairs_dataframe: pd.DataFrame) -> pd.DataFrame:

"""Get rid of pairs that we definitely are not interested in.

This will greatly speed up the later backtesting computations, as we do not need to

calculate the opening volumes for thousands of pairs.

Note that may induce survivorship bias - we use thiws mainly

to ensure the example strategy completes fast enough.

"""

pairs: pd.DataFrame = all_pairs_dataframe.loc[

(all_pairs_dataframe['buy_volume_all_time'] > prefilter_min_buy_volume) # 500k min buys

]

return pairs

exchange_universe = client.fetch_exchange_universe()

# Decompress the pair dataset to Python map

columnar_pair_table = client.fetch_pair_universe()

# Make our universe 40x smaller and faster to compute

filtered_pairs = prefilter_pairs(columnar_pair_table.to_pandas())

# Make the trading pair data easily accessible

pair_universe = PandasPairUniverse(filtered_pairs)

wanted_pair_ids = pair_universe.get_all_pair_ids()

# Get daily candles as Pandas DataFrame

all_candles = client.fetch_all_candles(TimeBucket.d1).to_pandas()

all_candles = all_candles.loc[all_candles["pair_id"].isin(wanted_pair_ids)]

candle_universe = GroupedCandleUniverse(prepare_candles_for_qstrader(all_candles), timestamp_column="Date")

all_liquidity = client.fetch_all_liquidity_samples(TimeBucket.d1).to_pandas()

all_liquidity = all_liquidity.loc[all_liquidity["pair_id"].isin(wanted_pair_ids)]

all_liquidity = all_liquidity.set_index(all_liquidity["timestamp"])

liquidity_universe = GroupedLiquidityUniverse(all_liquidity)

logger.info("Datafeeds set up. We have %d pairs, %d candles, %d liquidity samples",

pair_universe.get_count(),

candle_universe.get_candle_count(),

liquidity_universe.get_sample_count())

INFO:Notebook:Datafeeds set up. We have 1633 pairs, 349168 candles, 350704 liquidity samples

Creating the strategy#

Here is the core of our strategy: alpha model.

We create an alpha signal source

LiquidityThresholdReachedAlphaModelfor the strategyOur backtesting signal source uses “the daily new token reaching the target liquidity” as the buy signal

[5]:

from typing import Dict

from qstrader.alpha_model.alpha_model import AlphaModel

def update_pair_liquidity_threshold(

now_: pd.Timestamp,

threshold: float,

reached_state: dict,

pair_universe: PandasPairUniverse,

liquidity_universe: GroupedLiquidityUniverse) -> dict:

"""Check which pairs reach the liquidity threshold on a given day.

:param threshold: Available liquidity, in US dollar

:return: Dict of pair ids who reached the liquidity threshold and how much liquidity they had

"""

new_entries = {}

# QSTrader carries hours in its timestamp like

# Timestamp('2020-10-01 14:30:00+0000', tz='UTC')

# as it follows NYSE market open and close timestamps.

# Capitalgram candle timestamps are in days and mightnight, so we fix it here.

ts = pd.Timestamp(now_.date())

for pair_id in pair_universe.get_all_pair_ids():

# Skip pairs we know reached liquidity threshold earlier

if pair_id not in reached_state:

# Get the todays liquidity

liquidity_samples = liquidity_universe.get_samples_by_pair(pair_id)

# We determine the available liquidity by the daily open

try:

liquidity_today = liquidity_samples["open"][ts]

except KeyError:

liquidity_today = 0

if liquidity_today >= threshold:

reached_state[pair_id] = now_

new_entries[pair_id] = liquidity_today

return new_entries

class LiquidityThresholdReachedAlphaModel(AlphaModel):

"""

A simple AlphaModel that provides a single scalar forecast

value for each Asset in the Universe.

Parameters

----------

signal_weights : `dict{str: float}`

The signal weights per asset symbol.

universe : `Universe`, optional

The Assets to make signal forecasts for.

data_handler : `DataHandler`, optional

An optional DataHandler used to preserve interface across AlphaModels.

"""

def __init__(

self,

exchange_universe: ExchangeUniverse,

pair_universe: PandasPairUniverse,

candle_universe: GroupedCandleUniverse,

liquidity_universe: GroupedLiquidityUniverse,

min_liquidity,

max_assets_per_portfolio,

data_handler=None

):

self.exchange_universe = exchange_universe

self.pair_universe = pair_universe

self.candle_universe = candle_universe

self.liquidity_universe = liquidity_universe

self.data_handler = data_handler

self.min_liquidity = min_liquidity

self.max_assets_per_portfolio = max_assets_per_portfolio

self.liquidity_reached_state = {}

def construct_shopping_basked(self, dt: pd.Timestamp, new_entries: dict) -> Dict[int, float]:

"""Construct a pair id """

# Sort entire by volume

sorted_by_volume = sorted(new_entries.items(), key=lambda x: x[1], reverse=True)

# Weight all entries equally based on our maximum N entries size

pick_count = min(len(sorted_by_volume), self.max_assets_per_portfolio)

ts = pd.Timestamp(dt.date())

if pick_count:

weight = 1.0 / pick_count

picked = {}

for i in range(pick_count):

pair_id, vol = sorted_by_volume[i]

# An asset may have liquidity added, but not a single trade yet (EURS-USDC on 2020-10-1)

# Ignore them, because we cannot backtest something with no OHLCV data

candles = self.candle_universe.get_candles_by_pair(pair_id)

# Note daily bars here, not open-close bars as internally used by QSTrader

if ts not in candles["Close"]:

name = self.translate_pair(pair_id)

logger.warning("Tried to trade too early %s at %s", name, ts)

continue

picked[pair_id] = weight

return picked

# No new feasible assets today

return {}

def translate_pair(self, pair_id: int) -> str:

"""Make pari ids human readable for logging."""

pair_info = self.pair_universe.get_pair_by_id(pair_id)

return pair_info.get_friendly_name(self.exchange_universe)

def __call__(self, dt) -> Dict[int, float]:

"""

Produce the dictionary of scalar signals for

each of the Asset instances within the Universe.

Parameters

----------

dt : `pd.Timestamp`

The time 'now' used to obtain appropriate data and universe

for the the signals.

Returns

-------

`dict{str: float}`

The Asset symbol keyed scalar-valued signals.

"""

# Refresh which cross the liquidity threshold today

new_entries = update_pair_liquidity_threshold(

dt,

self.min_liquidity,

self.liquidity_reached_state,

self.pair_universe,

self.liquidity_universe

)

logger.debug("New entries coming to the market %zs %s", dt, new_entries)

picked = self.construct_shopping_basked(dt, new_entries)

if picked:

logger.debug("On day %s our picks are", dt)

for pair_id, weight in picked.items():

logger.debug(" %s: %f", self.translate_pair(pair_id), weight)

else:

logger.debug("On day %s there is nothing new interesting at the markets", dt)

return picked

logger.info("Alpha model created")

INFO:Notebook:Alpha model created

Setting up the strategy backtest#

We have alpha model and trading universe set up, so next we will create a backtest simulation where we feed all the data we set up for the backtest session.

[6]:

from qstrader.asset.universe.static import StaticUniverse

from qstrader.data.backtest_data_handler import BacktestDataHandler

from qstrader.simulation.event import SimulationEvent

from qstrader.simulation.everyday import EverydaySimulationEngine

from qstrader.trading.backtest import BacktestTradingSession

from tradingstrategy.frameworks.qstrader import CapitalgramDataSource

data_source = CapitalgramDataSource(exchange_universe, pair_universe, candle_universe)

strategy_assets = list(data_source.asset_bar_frames.keys())

strategy_universe = StaticUniverse(strategy_assets)

data_handler = BacktestDataHandler(strategy_universe, data_sources=[data_source])

# Construct an Alpha Model that simply provides a fixed

# signal for the single GLD ETF at 100% allocation

# with a backtest that does not rebalance

strategy_alpha_model = LiquidityThresholdReachedAlphaModel(

exchange_universe,

pair_universe,

candle_universe,

liquidity_universe,

min_liquidity,

max_assets_per_portfolio)

strategy_backtest = BacktestTradingSession(

start,

end,

strategy_universe,

strategy_alpha_model,

initial_cash=initial_cash,

rebalance='daily',

long_only=True, # Spot markets do not support shorting

cash_buffer_percentage=cash_buffer,

data_handler=data_handler,

simulation_engine=EverydaySimulationEngine(start, end)

)

logger.info("Strategy backtest set up")

Initialising simulated broker "Backtest Simulated Broker Account"...

INFO:qstrader.broker.portfolio.portfolio:(2020-10-01 14:30:00) Portfolio "000001" instance initialised

INFO:qstrader.broker.portfolio.portfolio:(2020-10-01 14:30:00) Funds subscribed to portfolio "000001" - Credit: 0.00, Balance: 0.00

(2020-10-01 14:30:00) - portfolio creation: Portfolio "000001" created at broker "Backtest Simulated Broker Account"

INFO:qstrader.broker.portfolio.portfolio:(2020-10-01 14:30:00) Funds subscribed to portfolio "000001" - Credit: 10000.00, Balance: 10000.00

(2020-10-01 14:30:00) - subscription: 10000.00 subscribed to portfolio "000001"

INFO:Notebook:Strategy backtest set up

Running the QSTrader strategy#

Next we run the strategy. This can take potentially many minutes, as it crunches through some data.

The notebook displays a HTML progress bar is displayed during the run, and the estimation when the simulation is complete.

[7]:

from tqdm.autonotebook import tqdm

# Supress excessive qstrader logging output

logging.getLogger("qstrader").setLevel(logging.WARNING)

logger.info("Running the strategy")

max_events = len(strategy_backtest.prefetch_simulation_events())

# Run the test with a nice progress bar

with tqdm(total=max_events) as progress_bar:

def progress_callback(idx: int, dt: pd.Timestamp, evt: SimulationEvent):

progress_bar.set_description(f"Simulation at day {dt.date()}")

progress_bar.update(1)

strategy_backtest.run(progress_callback=progress_callback)

logger.info("Backtest complete")

INFO:Notebook:Running the strategy

WARNING:Notebook:Tried to trade too early EURS - USDC, pair #196 on Uniswap v2 at 2020-10-02 00:00:00

WARNING:Notebook:Tried to trade too early BBTC - WETH, pair #27023 on Uniswap v2 at 2020-12-10 00:00:00

WARNING:qstrader.broker.simulated_broker:WARNING: Estimated transaction size of 1317.00 exceeds available cash of 885.21. Transaction will still occur with a negative cash balance.

WARNING: Not enough cash in the portfolio to carry out transaction. Transaction cost of 1316.5333007574081 exceeds remaining cash of 885.2106907751349. Transaction will proceed with a negative cash balance.

INFO:Notebook:Backtest complete

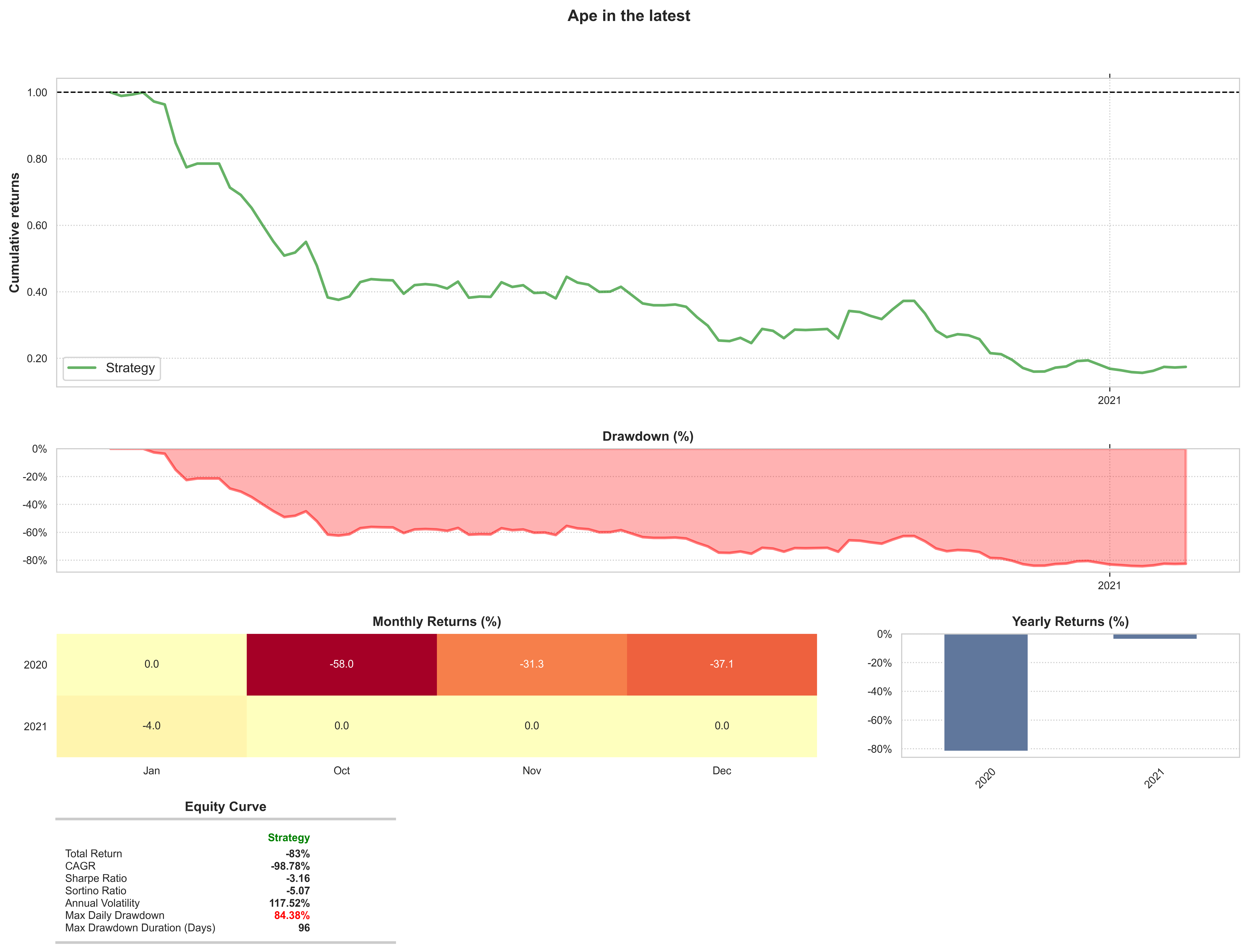

Analyzing the strategy results#

After the strategy is run, we will display charts and statistics on its performance.

[8]:

from tradingstrategy.frameworks.qstrader import analyse_portfolio

# "000001" is the default name given for the default portfolio by QSTrader

portfolio = strategy_backtest.broker.portfolios["000001"]

trade_analysis = analyse_portfolio(portfolio.history)

Summary of trades#

This displays number of trades, how many we won and lost.

[9]:

from IPython.core.display import HTML

from IPython.display import display

from tradingstrategy.analysis.tradeanalyzer import TradeSummary

cash_left = strategy.broker.get_cash()

summary: TradeSummary = trade_analysis.calculate_summary_statistics(initial_cash, cash_left)

display(HTML(summary.to_dataframe().to_html(header=False)))

| Cash at start | $10,000.00 |

|---|---|

| Value at end | $1,698.55 |

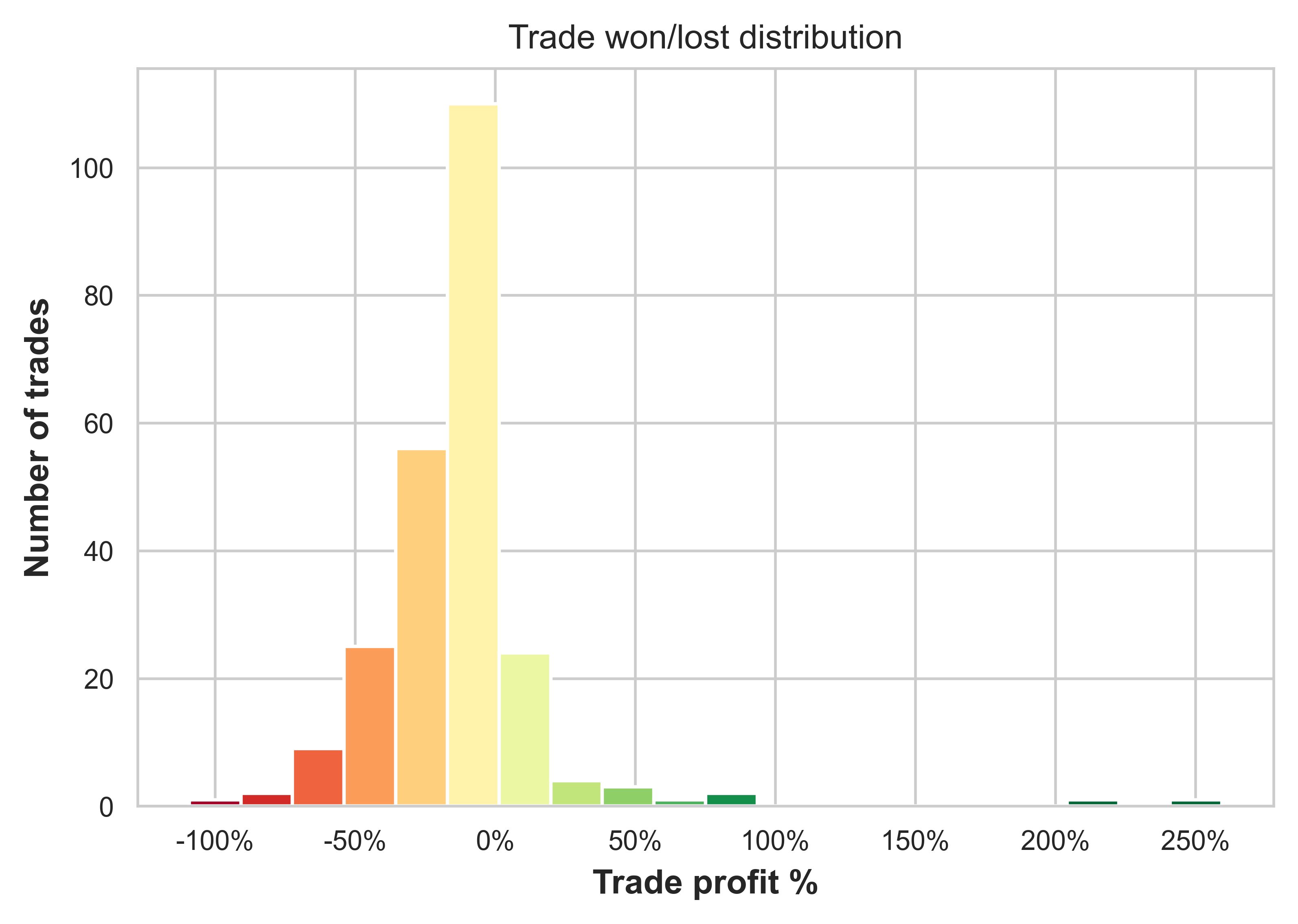

| Trade win percent | 36% |

| Total trades done | 234 |

| Won trades | 85 |

| Lost trades | 148 |

| Zero profit trades | 1 |

| Positions open at the end | 5 |

| Realised profit and loss | $-8,301.45 |

| Portfolio unrealised value | $1,108.28 |

| Cash left at the end | $590.27 |

Tearsheet chart#

Tearsheet displays the portfolio profit and risk over the time.

[10]:

from qstrader.statistics.tearsheet import TearsheetStatistics

tearsheet = TearsheetStatistics(

strategy_equity=strategy_backtest.get_equity_curve(),

title=f'Ape in the latest'

)

tearsheet.plot_results()

Trade success histogram#

Show the distribution of won and lost trades as a histogram.

[11]:

from matplotlib.figure import Figure

from tradingstrategy.analysis.tradeanalyzer import expand_timeline

from tradingstrategy.analysis.profitdistribution import plot_trade_profit_distribution

timeline = trade_analysis.create_timeline()

expanded_timeline, _ = expand_timeline(exchange_universe, pair_universe, timeline)

fig: Figure = plot_trade_profit_distribution(expanded_timeline, bins=20)

Trading timeline#

The timeline displays individual trades the strategy made. This is good for figuring out some really stupid trades the algorithm might have made.

[ ]:

from tradingstrategy.analysis.tradeanalyzer import expand_timeline

# Generate raw timeline of position open and close events

timeline = trade_analysis.create_timeline()

# Expand timeline with human-readable exchange and pair symbols

expanded_timeline, apply_styles = expand_timeline(exchange_universe, pair_universe, timeline)

# Do not truncate the row output

with pd.option_context("display.max_row", None):

display(apply_styles(expanded_timeline))

Conclusion#

An ape in strategy with a parameters chosen with Stetson-Harrison method is not profitable.

However, this is an interactive notebook. Click Launch binder button at the top, edit this strategy live and try to come up with better parameters.